PPT? Stocks Rescued By Biggest Intraday Dip-Buy Since 2011 EU Crisis Bailouts

"Be careful what you wish for" appears to be the lesson for stock investors this week as recovery and reflation hopes/hypes sent real and nominal rates soaring, triggering trouble in the momo/growthy names that have soared "to the moon" and neither Powell, Bullard, Evans, nor Kashkari would volunteer any resolution on "moar" via a 'Twist' or on the SLR overhang that has many worried.

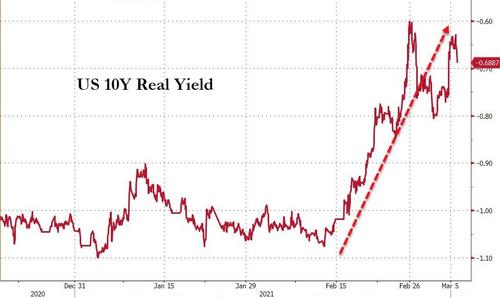

As real rates have spiked, 'stonks' have tumbled...

The Nasdaq is down 3 weeks in a row (worst streak since September), but the late-day sudden panic-bid pushed the S&P and Dow into the green for the week...

Today was utter chaos - just look at the swings in small caps! From +2% pre-open, to down 2.5% as SHTF, and back up to gains over 2% into the close...

As shorts were dramatically squeezed...

Source: Bloomberg

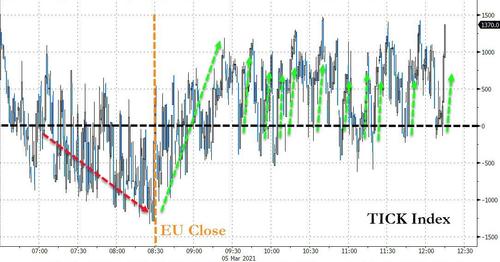

NOTE that the selling immediately halted the second that European markets closed...and every single time we dipped negative on TICK, another mysterious bid immediately lifted the markets...

Source: Bloomberg

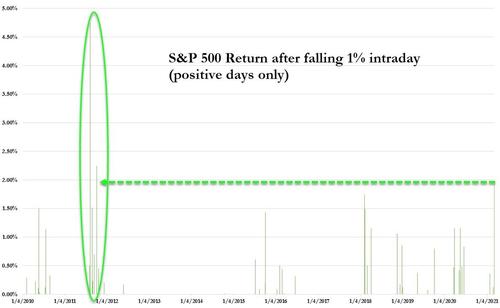

Today's sudden reversal is the biggest S&P 500 gain when it had dropped by over 1% intraday since 2011's European debt crisis...

Now that is the kind of v-shaped and sudden recovery that any Plunge Protection Team would be proud of...

Nasdaq ended the week down for the year (and the S&P bounced off unch for the year)...

Source: Bloomberg

The swings today were very technical nature - S&P ripped back up to test its 50DMA from below, Nasdaq bounced off its 100DMA, Dow bounced off its 50DMA, and Small Caps ripped back up above their 50DMA intraday...

Energy stocks soared 10% on the week as Tech and Consumer Discretionary ended red...

Source: Bloomberg

Nasdaq breadth is a bloodbath...

Source: Bloomberg

Hedgies were hammered on the week but the bounce back today helped ease some of the pain...

Source: Bloomberg

Cathie Wood had an ugly week (but things were eased by the mysterious panic bid that occurred as Europe closed)...

And TSLA tumbled...

But BUZZ was panic-bid into the green today...

VIX had a wild ride this week, spiking to 32 amid Powell's puke and dumping back below 25 today...

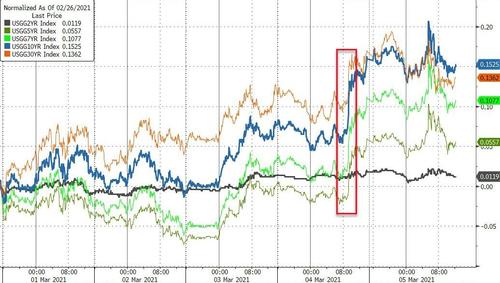

Bond yields surged on the week with the longer-end worst with Powell's failure to deliver the biggest catalyst...

Source: Bloomberg

10Y Yields surged this week, breaking above last week's dismal-auction spike highs...

Source: Bloomberg

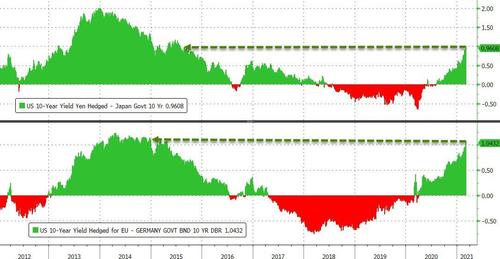

The surge in yields has given overseas buyers the opportunity for major yield enhancement (FX-hedged) with European and Japanese investors able to reap over 100bps buying FX-hedge USTs over their local bonds...

Source: Bloomberg

Real yields spiked this week...

Source: Bloomberg

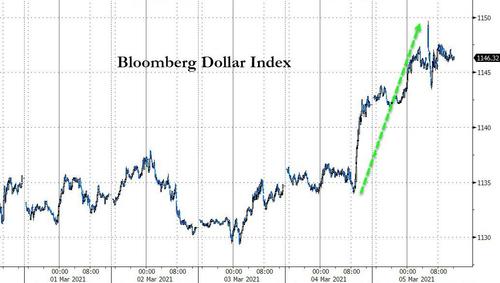

The dollar surged to its strongest since Thanksgiving (with its biggest week since October), mostly driven post-Powell...

Source: Bloomberg

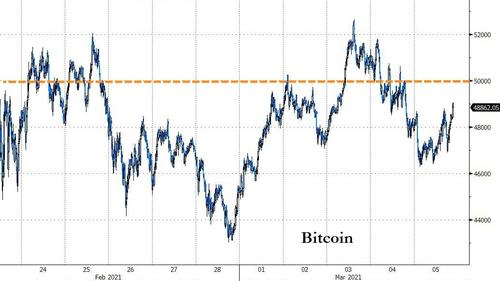

Crypto had a choppy week but all the majors ended higher...

Source: Bloomberg

As Bitcoin toyed with $50k...

Source: Bloomberg

Oil prices continued their charge higher this week, helped by a surprise no-hike from OPEC+, sending WTI back above $66 for the first time since April 2019...

Gold was clubbed like a baby seal this week with futures back below $1700 for the first time since Jun 2020 (down for the 5th week in the last 6)

And silver is back below $26, erasing all of the Reddit-Raiders spike...

Finally, it appears that the trend towards delusion is finally starting to shift back to some form of reality as mega-cap tech (profitable) dramatically outperformed non-profitable tech in the last couple of weeks...

Source: Bloomberg

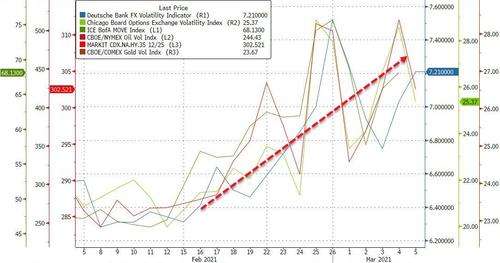

And if you wondered whether The Fed has lost control, every asset-class saw vols explode this week...