It was the kind of warning familiar to Fox viewers in the Trump era: An immigrant posed a danger to U.S. security.

Only this time, the purported threat wasn’t part of an “invasion” from Mexico or Guatemala — he controls the fate of the retirement investments of millions of people in California.

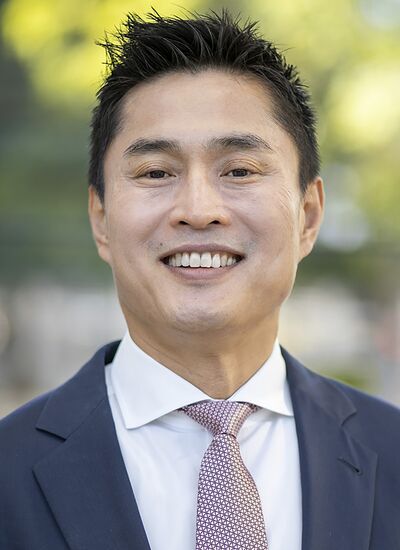

His name is Ben Meng. And there was his face, imposed over a waving American flag, as Tucker Carlson, the network’s conservative 8 p.m. host, listened to grave warnings about just where Meng’s loyalties might lie.

Suddenly Meng, a U.S. citizen who’d grown up in China, has been swept up in the debate over immigration, national security and the politics of who gets to be a “real American.” Last week, a Republican lawmaker took to the prime-time TV show and accused the man who oversees California’s $400 billion state pension fund of being a tool for the Chinese government, funneling American money into Chinese hands.

Now, Calpers is fighting back and rallying some of Wall Street’s biggest names to quell the charge. Even in a time of heightened scrutiny over U.S. investments in China, the targeting of Meng, they say, goes too far.

“This type of attack on an accomplished American citizen is unwarranted,” said Stephen Schwarzman, chief executive officer of private equity firm Blackstone, which invests money on behalf of Calpers. “Ben is a talented investor who has done a tremendous job for the pensioners.”

In 2018, when Meng was named chief investment officer of Calpers, his experience in China was touted as an asset. Now, Indiana Congressman Jim Banks is using that same background as reason to investigate Meng’s allegiance and win backing for a crackdown on government workers’ dollars flowing into Chinese companies.

The explosive allegations center around a three-year stint that Meng did from 2015 helping oversee China’s $3 trillion in currency reserves. During that time, he was deputy CIO of the State Administration of Foreign Exchange, or SAFE.

Meng was hired for his job at the Chinese fund via a government recruitment plan known as the Thousand Talents Program. That, according to Banks, likely includes a lifelong mission to support Chinese authorities.

Banks called for Meng to be fired and said Calpers’s investments in Chinese companies — which amount to roughly 1% of assets and is done by passively tracking indexes — must be investigated because of what the lawmaker alleges are Meng’s “cozy relationship” with the Chinese communist party.

Meng, 50, took exception to Banks’s claims and said his connections with Thousand Talents ended when he left the SAFE two years ago.

‘Proud American’

“SAFE used the Thousand Talents Program to be able to hire U.S. contractors,” he said in a statement. “I was associated with the program through my employment with SAFE. Any connection to the program ended when I left. I am a proud American citizen.”

Meng also countered the claim he steered Calpers to support China’s military or repression of human rights. The fund excludes companies banned by the U.S. Treasury’s Office of Foreign Assets Control.

“Calpers has public equity investments in 50 countries, and the method of investing in them has not changed at all since I came back,” he said. “We’re an index investor and it’s been that way for many years. The index provider determines what equities to hold, not Calpers.”

Some of the leading lights in finance have come to his defense.

Oaktree Capital Founder Howard Marks, who has known Meng for a decade and also counts Calpers as one of its clients, said he was particularly outraged when he saw Banks attack Meng on Fox.

“It goes against American values to impugn someone’s character on the basis of their family’s national origin,” Marks said.

Fighting Chinese espionage and unfair trade practices is a valid pursuit, but dragging a Chinese American into the fray is unfair, according to Niall Ferguson, a friend of Meng’s and fellow at the Hoover Institution. Early last year, Ferguson reached out to Meng to warn him that rising trade tensions could be a problem for people like him.

“If this turns into an opportunity for people to have a go at a Chinese-born U.S. citizen, then I’m opposed to it,” he said. “People like Ben are the people we don’t want to alienate.”

Calpers dispatched Meng’s top deputy, Dan Bienvenue, to Washington to meet with Banks and followed up with a Feb. 20 letter from CEO Marcie Frost. She noted that Calpers is one of many public pensions that use index-tracking strategies. One of those happens to be the Indiana Public Retirement System. Banks’s most recent public disclosures showed some of his own assets were held in the pension, which invests in index funds that own the same Chinese companies he has criticized.

Those explanations have done little to placate Banks or his Republican allies on Capitol Hill. Arkansas Senator Tom Cotton — one of the leading China hawks in Congress — and Wyoming representative Liz Cheney have expressed support for Banks’s inquiry into Calpers and Meng’s ties to the Chinese government.

The heightened scrutiny comes on the heels of growing tensions between the U.S. and China. In addition to a simmering trade war, the Trump administration has been exploring possible restrictions on investments into China, with a particular focus on those made by U.S. government retirement funds. Legislation to block certain investments to China was introduced in the House and Senate last year.

Singled Out

Secretary of State Mike Pompeo singled out Calpers in a Feb. 8 speech warning about China’s campaign against U.S. national interests.

“The largest public pension fund in the country is invested in companies that supply the People’s Liberation Army that puts our soldiers, sailors, airmen and Marines at risk,” Pompeo said.

Of course, concerns about China’s growing geopolitical ambitions and its efforts to undermine U.S. national security, are real. And there’s bipartisan support for greater scrutiny of TTP, developed by the Chinese government to recruit overseas researchers to apply their skills locally.

China published the names of TTP recruits online until September 2018, when a Chinese American engineer (and TTP participant) working for General Electric was arrested for allegedly stealing tech secrets from the company. Last month, Charles Lieber, a leading Harvard nanoscientist, was charged with lying about his work with the program.

Plus, there’s an argument to be made that passive investors need to be more mindful of where they put their money.

“State public employee pension systems should be especially alert to higher risk Chinese and Russian corporate human rights and national security abusers in their investment portfolios, including those embedded in popular indexes and associated ETFs,” said Roger Robinson, CEO of risk consultancy RWR Advisory, who has been pushing for such an action for at least three decades.

Nevertheless, Robert Daly of the Kissinger Institute on China and the U.S. said those concerns don’t justify the blowback that Meng is getting now, even if he was involved with TTP at the time.

“Unless there is evidence that he has committed illegal acts, I don’t see any reason to place him under suspicion,” he said.

This is a demo advert, you can use simple text, HTML image or any Ad Service JavaScript code. If you're inserting HTML or JS code make sure editor is switched to "Text" mode.